Scammers are lurking

The scam epidemic taking hold among Britain’s desperate job hunters is awful but real.

People are desperately looking for work and can often be contacted through social media about a job opportunity. Offering money for simple things like social media likes.

If you work hard and do the hours you will be financially rewarded.

They may well ask you to fill in an application process and training – much like a typical job.

But it turned out to be a scam. And as the job market becomes increasingly saturated with more people competing for fewer roles, falling for these too-good-to-be-true adverts has become a national epidemic.

Between 2022 and 2024, the number of job and recruitment scams jumped by more than 130pc, according to the latest figures available from Action Fraud. The national reporting centre received 4,900 cases alone last year, up from just over 2,000 in 2022.

Advertisement

- Shopping Jotter Easy to Use Shopping List Pad Good Value for Money Jotter Note Pads Made Up of Great Quality Material to…

- Compact Shopping Jotter Designed for Fast List Making Organized Grocery Planning and Efficient Daily Tasks Notebook Jott…

- Jotter Pads Crafted for Clear Checklists Meal Planning and Budget Tracking to Do List Pad Is Durable Reliable and Organi…

They might ask you to deposit the money you have earnt into an external wallet on a crypto trading platform, before buying specific cryptocurrencies as instructed on a separate website.

It may be a small sum at first, but then you receive “rewards” on the website for completing the tasks, then comes the sting as you may well be asked to put in more and more of your own cash.

They can then employ various methods to persuade you to deposit larger sums such as offering big financial bonuses if only you deposit more. Or stating there was a problem and the only way to unfreeze the account is deposit even more of your own money.

These types of people are unscrupulous and have no problem stealing from people who clearly don’t have money to loose. Unfortunately they don’t care about your circumstances and will take your money and run.

As Britain grapples with a rising unemployment rate and a chaotic job market, job scams have become not only more prevalent but apparently more effective.

Similar to the spread of vaccine scams during the pandemic, criminal organisations’ decision to ramp them up in the current climate is a calculated move, says Giles Mason, of fraud campaign group Take Five.

“Criminals are always changing their methods to respond to the latest events,” he says. “They will try and target people they think they can exploit. So job scams usually affect people who are looking for a second income, but also for a new job, whether this is graduates or someone who is recently unemployed.”

The fraudsters involved in job scams are typically part of larger criminal networks, often abroad. Victims may also be used as “money mules” to unwittingly launder illegal funds by transferring their earnings from fake jobs to other bank accounts.

Nearly a quarter of all reported “mules” are involved in a job scam, according to Nationwide.

Watch for identity theft, the scammer will often pretend they have reviewed the victim’s CV and determined they would be ideal for a job at a company. In some cases they will go as far as setting up a call to discuss the job further, in a bid to win trust.

The aim is for the victim to send personal details to finalise their application, such as a passport, copies of utility bills and their National Insurance number. Once they have these, they can be used for fraudulent activity without the victim’s have any idea of what is going on behind their backs.

Job scammers prey on the knowledge that many who are looking for work have reached a point of desperation in their search. Ordinary job hunters may ignore the warning signs and they will capitalise on this by slowly building trust over days or even weeks, before creating a sense of urgency that requires the victim to act against their better judgement.

Getting the money back can be painstaking, if not impossible. You may crawl some money back from the banks, but it is likely to be a small amount and nowhere near what you have lost.

Also see: Social Media Traps

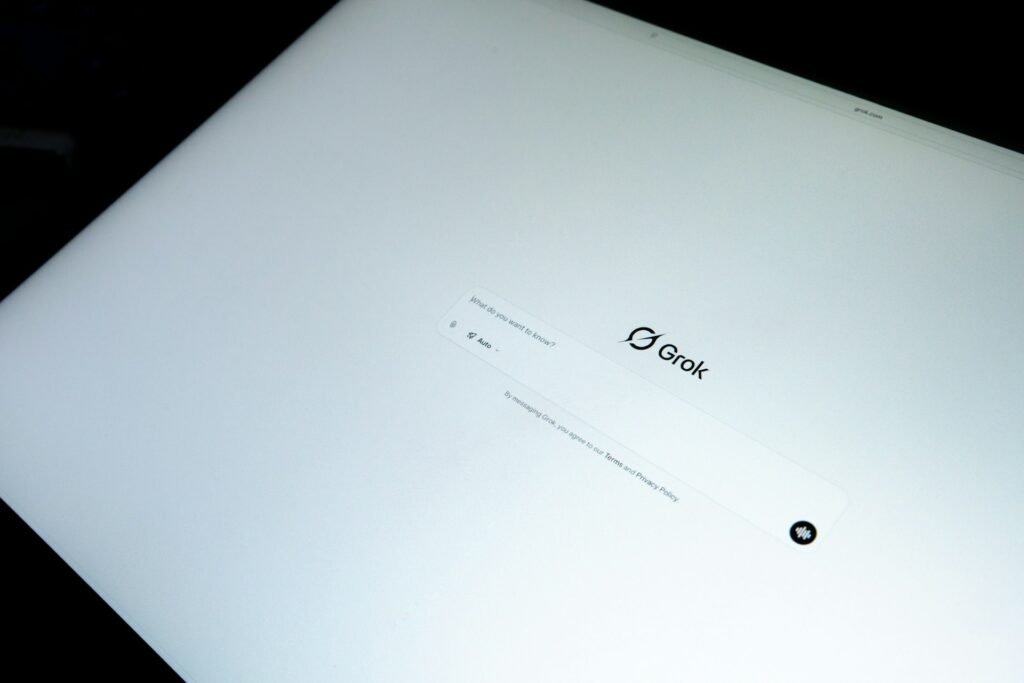

While the Government has begun cracking down on mobile networks to stem the flood of scam calls and texts from abroad, social media remains wide open to abuse.

More than half of scams were linked to Meta platforms such as Facebook and Instagram in 2023, according to the Payment Systems Regulator, which is now part of the Financial Conduct Authority.

Measures designed to prevent their proliferation in the Online Safety Act only address paid-for fraudulent adverts appearing on their services, meaning thousands of free posts are not scrutinised at all.

Advertisement

If in doubt check their website is genuine, it must be https:// not just http:// in their website address and look for the padlock before the website address too, also you can check to see if they are a registered business with companies house.

Typical signs to look out for are misspellings, bad grammar and broken links. A poorly constructed website is a sure sign to be very wary of proceeding forward with any dealings with them. This is now changing as AI becomes more and more involved in criminal networks, they are able to use this technology to avoid spelling mistakes, bad grammar etc. It is now getting harder to spot the difference between genuine and fake businesses online.

You could go further and ring them up and see if anybody answers and what they say and how they come across. Check for company reviews and mentions on their particular field of expertise online from other sites.

If you feel things aren’t adding up and you have doubts as tempting at the offer might be, be very careful before giving any personal details and certainly not financial details until much further down the line.

We live in sad times as criminals operate in walks of life and become smarter and more ruthless online than ever before.

Keep up with my latest news from Cyber England.